We Can Help You!

Since we represent all of the major Medicare Supplement companies, we are able to "shop" them for you to ensure quality coverage at the lowest price.

Medicare supplements

Medicare Supplement Plans help pay what is covered by original Medicare and what isn't. For instance, Medicare Supplement Plans would cover co-pays or deductibles.

Enrollment for medicare supplement programs

Open enrollment for Medicare coverage begins the first day of the month you are 65 AND enrolled in Medicare Part B. This period runs for six months. Purchasing a Medicare plan during this initial enrollment period rewards you no medical underwriting (You cannot be denied coverage or charged extra for health reasons).

After the initial enrollment period, you must complete a medical questionnaire.

Our recommendation is to plan ahead! Purchase coverage as soon as you are first eligible

Types of medicare coverage

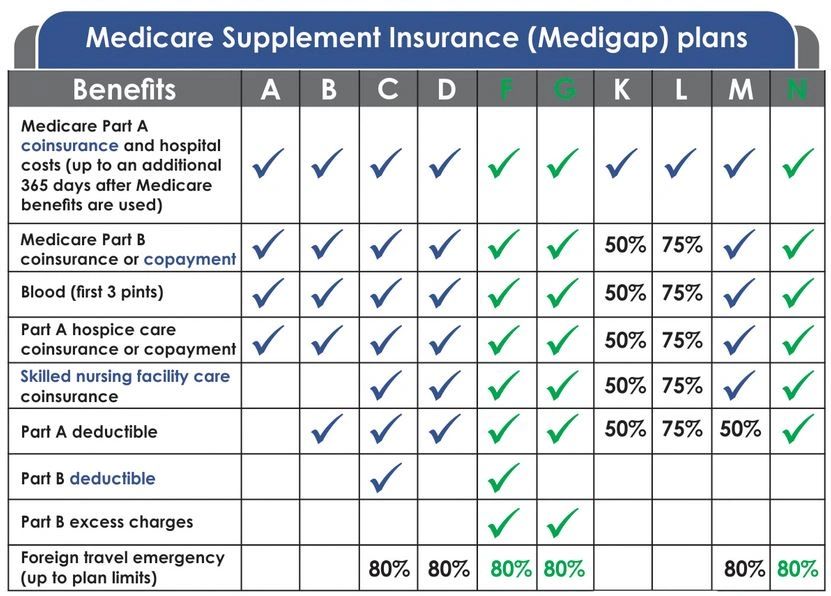

Standardized Medicare Supplement plans are identified by the letters A through N. Each policy with the same letter must offer the same basic benefits, no matter which insurance company sells it. The only difference between Medigap plans with the same letter sold by different insurance companies is typically the cost.

FAQs

What are the requirements for obtaining Medicare Supplements?

Original Medicare Part A and B must be held in order to purchase a Medicare Supplement. Part A is a hospital and Part B is medical.

Medicare Supplements can not be purchased if Medicare Part C is held. Medicare Part C is medicare advantage.

What are the limitations of Medicare Supplements?

They do not cover prescription drugs.

Cornerstone Insurance Solutions

Cornerstone Insurance Solutions 410 Neff Ave., Suite 213 Harrisonburg, VA 22801 us